On February 1, 2025, Finance Minister Nirmala Sitharaman presented the Union Budget, outlining India’s economic priorities and fiscal strategies for the upcoming year. The budget focuses on infrastructure development, tax reforms, digital economy, healthcare, agriculture, and sustainable growth.

1. Infrastructure Development

The government has significantly increased funding for infrastructure projects to drive long-term growth and improve connectivity nationwide. Key initiatives include:

- Rural Infrastructure Enhancement: Investments in rural roadways, sanitation, and water management aim to bridge the rural-urban divide.

- National Infrastructure Pipeline (NIP) Expansion: The NIP now includes sectors like electric mobility and green energy, promoting sustainable development.

- Urban Modernization: Allocations for smart cities focus on technology integration, smart utilities, and public transportation systems.

2. Taxation Reforms

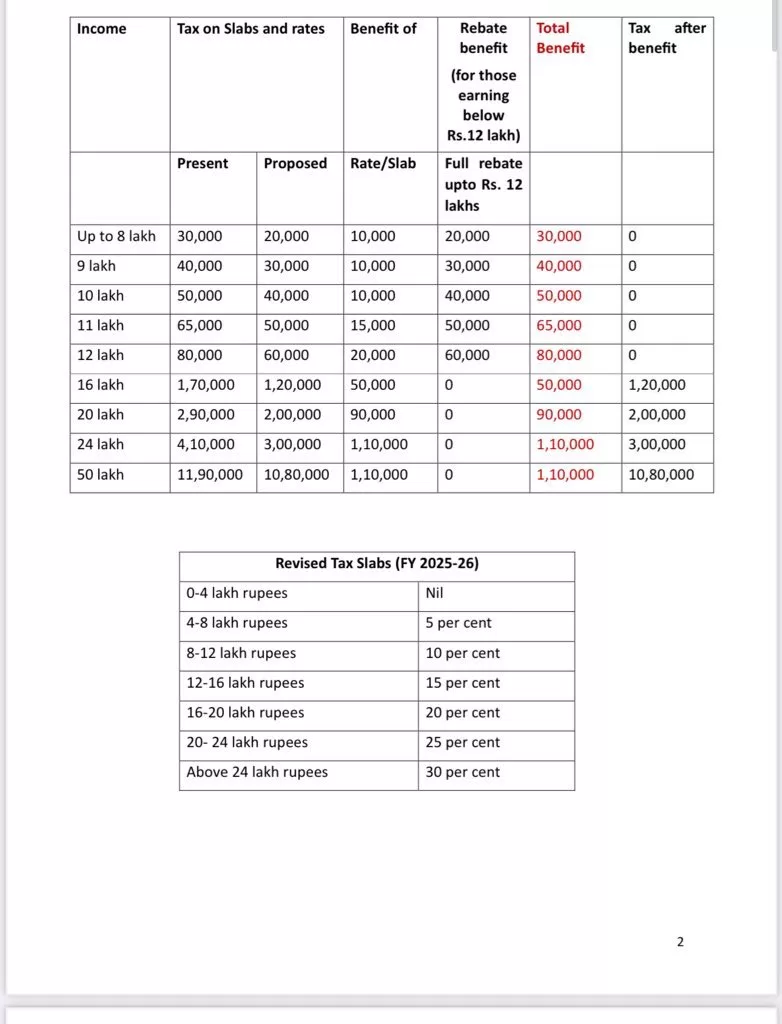

The budget introduces measures to simplify the tax system and provide relief to taxpayers:

- Revised Tax Slabs: Restructured tax brackets offer significant relief for middle-class taxpayers.

- Green Investment Incentives: New tax deductions encourage investments in green technologies, renewable energy projects, and electric vehicles.

- Business Taxation Eased: Small businesses and startups benefit from tax credits, and corporate tax rates are adjusted to attract investment.

3. Digital Economy and Innovation

Recognizing the importance of technology, the budget emphasizes:

- Startup Support: Tax reliefs, grants, and simplified regulations encourage innovation in sectors like AI and biotechnology.

- Cybersecurity Investment: Increased spending ensures the protection of digital assets and data.

- Digital Literacy: Nationwide campaigns prepare the workforce for the digital economy.

4. Healthcare and Education

Investments in these sectors aim to build a healthier and more skilled population:

- National Health Mission Expansion: Focus on preventive care, digital health, and access in underserved regions.

- Skill Development Funding: Emphasis on vocational training in high-growth sectors like AI and clean energy.

5. Agriculture Support

The budget addresses long-term agricultural reforms:

- Direct Income Support: Increased cash transfers under the PM-Kisan Yojana boost farmers’ financial security.

- Sustainable Practices: Tax incentives promote water-saving technologies and organic farming.

6. Green Growth Initiatives

Sustainability is a core focus:

- Clean Energy Investments: Significant funds allocated for renewable energy infrastructure, including solar, wind, and green hydrogen projects.

The Union Budget 2025 reflects the government’s commitment to fostering economic growth, technological advancement, and sustainable development, aiming to position India as a leading global economy.