Sankarsh Chanda: The Youngest Entrepreneur

Sankarsh founded Savart, a financial technology company that helps users invest in stocks, mutual funds, and bonds. The official name of his company is Svobodha Infinity Investment Advisors Private Limited.

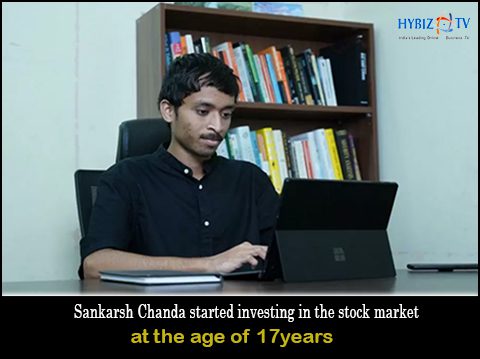

This stock market prodigy employs 35 people in a 2,000-square-foot office in Hyderabad’s Gagan Mahal. He founded Savart in 2017 with an investment of Rs. 8 lakh after leaving university. Sankarsh Chanda, 19, wants Savart, a Hyderabad-based startup that offers investment advice based on a psychometric test of your temperament and needs, to make investing in stocks and mutual funds easier.

Sankarsh was a sophomore at B.Tech Computer Science at Bennett University in Greater Noida when he decided to drop out and pursue stock trading full-time. After graduating from Class 12 at Slate – The School in Hyderabad, he started investing in the stock market in 2016. He started with $2,000 and increased his investment over the next two years. His investment grew quickly and he used part of the profits to start his business. “Over the course of two years I’ve invested about 1.5 lakh.” Within two years, the market value of my shares rose to approximately Rs. 13 lakh,” recalls Sankarsh.To start his company in 2017, he sold shares worth 8 lakh. He invested the rest of the money in the market and continued funding his startup with his profits.

“Now I have a net worth of 100 million rupees.” It’s based not only on my investment in the stock market but also on the valuation of my company,” says Sankarsh, who became interested in the stock market at the age of 14 after reading an article by American economist Benjamin Graham, who known as the “father” of value investing.

Sankarsh convinced her older sister to give her the Demat account when she was 14 years old. “I remember investing about Rs 2,000 – that was my first investment,” the Hyderabad-born entrepreneur recalls as he takes a trip down memory lane. That was the money he got from the school as a scholarship, which was more of a monthly payment. I had no experience back then with buying the cheapest stocks to get a lot of them.”