Mumbai, Bengaluru & Delhi-NCR Feature Among the Top 10 APAC Logistics Markets in Terms of Annual Rental Growth in 2022: Knight Frank

Mumbai, Bengaluru & Delhi-NCR Feature Among the Top 10 APAC Logistics Markets in Terms of Annual Rental Growth in 2022: Knight Frank

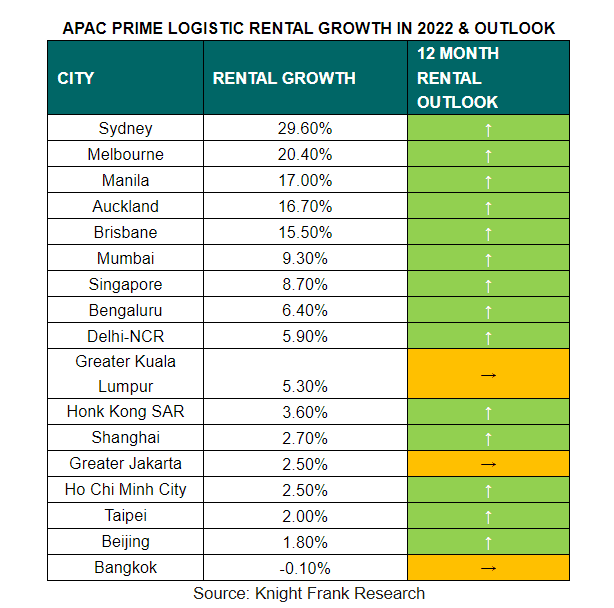

According to Knight Frank’s Asia-Pacific Logistics Highlight H2 2022 report the Asia-Pacific (APAC) logistics market saw a rental growth of 2.5% in year over year (YoY) terms, slightly lower than the 3% YoY increase seen in 2021. The key Indian cities Mumbai, Bengaluru and Delhi-NCR featured among the top 10 APAC markets in terms of warehousing rent growth in 2022. Data for Indian markets relates to financial year.

The report which tracks prime logistics rents across 17 key APAC markets cited that all the cities recorded stable or increasing rents in 2022, except Bangkok, which saw rent contract by 0.1%, its first decline since the start of the pandemic. In comparison, Australasia continued to outperform APAC markets, registering a strong performance at an average yearly growth rate of 12.9%. Sydney led the region in rental expansion with a 29.6% YoY growth.

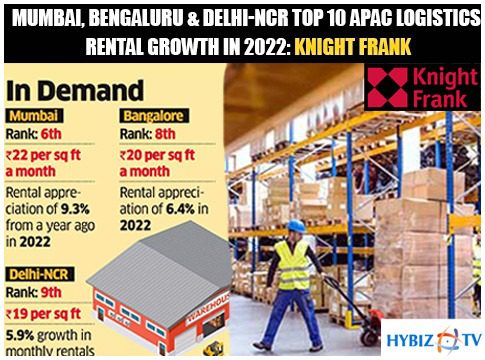

Mumbai ranked 6th in the APAC logistics market in terms of annual rental growth. At INR. 22/ sq ft/ month, the city witnessed rental appreciation of 9.3% YoY in 2022. Mumbai is expected to gain an additional warehousing space supply of 1.1 mn sq ft in 2023.

Bengaluru ranked 8th in the APAC logistics market on the basis of annual rental growth. At INR. 20/sq ft/ month, the city witnessed rental appreciation of 6.4% YoY in 2022. Bengaluru is expected to gain an additional warehousing space supply of 0.5 mn sq ft in 2023.

Delhi-NCR ranked 9th in the APAC logistics market based on annual rental growth. At INR 19/ sq ft/ month, the city witnessed rental growth of 5.9% YoY in 2022. Delhi NCR is expected to gain an additional warehousing space supply of 1.1 mn sq ft in 2023.

Shishir Baijal, Chairman & Managing Director, Knight Frank India said, “The Indian warehousing market has seen a healthy rise in rentals on the back of robust growth in demand during the year. The manufacturing and 3PL sectors were the major growth drivers in 2022 and should sustain momentum in 2023 as well. The healthy rent growth seen in 2022 across all markets after years of stagnation, is likely to remain in positive territory in 2023, as the market responds to the increased base level expectations from occupiers as well as a healthy demand outlook.”

Mumbai 6 th Incremental Rent growth in 2022 (YoY) – 9.3% Additional Supply in 2023 (mn sq ft) – 1.1

Bengaluru 8 th Incremental Rent growth in 2022 (YoY) – 6.4% Additional Supply in 2023 (mn sq ft) – 0.5

Delhi NCR 9 th Incremental Rent growth in 2022 (YoY) – 5.9% Additional Supply in 2023 (mn sq ft) – 1.1

Christine Li, head of research at Knight Frank Asia-Pacific, said: “Deteriorating sentiments resulted in negative rental growth registered for the first time since the pandemic. High interest rates and inflation are promoting companies to reassess or consolidate their inventory. On the upside, we still see strong demand for cold chain facilities, especially in APAC, as consumers continue to favour e-commerce grocery. Alongside the shortage of quality supply, logistics rents are still expected to grow in 2023, albeit tamed.”

According to a latest report by Knight Frank on Asia-Pacific Logistics Highlight H2 2022 the Asia-Pacific (APAC) logistics market saw a rental growth of 2.5% in year over year (YoY) terms, slightly lower than the 3% YoY increase seen in 2021. The key Indian cities Mumbai, Bengaluru and Delhi-NCR featured among the top 10 APAC markets in terms of warehousing rent growth in 2022. Data for Indian markets relates to financial year.

The report which tracks prime logistics rents across 17 key APAC markets cited that all the cities recorded stable or increasing rents in 2022, except Bangkok, which saw rent contract by 0.1%, its first decline since the start of the pandemic. In comparison, Australasia continued to outperform APAC markets, registering a strong performance at an average yearly growth rate of 12.9%. Sydney led the region in rental expansion with a 29.6% YoY growth.

Kindly find appended the press release on the same. Also, please find the report here.