The Bank of Baroda (BoB), a leading public sector bank of India, has launched the Pradhan Mantri Vidyalaxmi (PM-Vidyalaxmi) Scheme. The scheme is designed to offer financial assistance to deserving students pursuing higher studies. With this initiative, the government aims to prevent financial constraints from coming in the way of deserving students getting quality education.

Smooth Digital Process for Education Loans

Candidates can now apply for education loans online via the PM-Vidyalaxmi portal. The scheme aims to simplify the loan application process, making it more convenient and efficient. Bank of Baroda, with its wide network of 12 specialized Education Loan Sanctioning Cells (ELSC), 119 Retail Assets Processing Cells (RAPC), and more than 8,300 branches, is in a position to process student loan applications nationwide.

Shri Sanjay Mudaliar, Executive Director, Bank of Baroda, emphasized the importance of this initiative, saying, “The PM-Vidyalaxmi Scheme is a revolutionary scheme which keeps quality education within the reach of students from all walks of life. The end-to-end digital processing of education loans ensures that the whole process is seamless and hassle-free. We feel privileged to be one of the first banks to launch this scheme.”

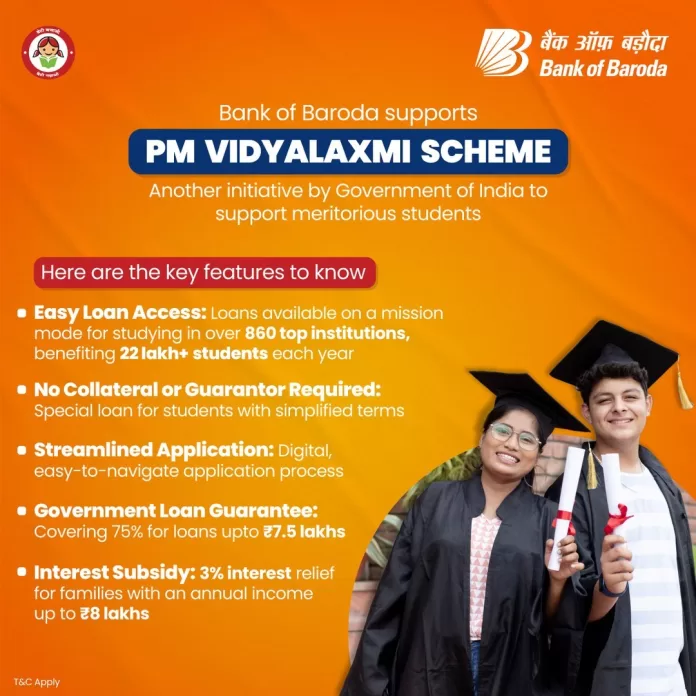

Key Features of the PM-Vidyalaxmi Scheme

The PM-Vidyalaxmi Scheme is a revolutionary step in student financing. The key benefits are:

- Guarantor-Free & Collateral-Free Loans: Students who are eligible can obtain education loans without collateral or a guarantor.

- Full Digital Application & Approval: The application and sanction process is entirely digital, reducing paperwork and ensuring speed.

- Loan Availability: Students who get admission to the top 860 listed Quality Higher Educational Institutions (QHEIs) can access these loans.

- Government Credit Guarantee: Government of India guarantees 75% of loans up to Rs. 7.5 lakh, promoting greater coverage.

- Interest Subvention for Low-Income Families: Interest subvention is offered either partially or completely to students belonging to economically weaker sections, making education more economical.

Other Education Loan Facilities from Bank of Baroda

In addition to the PM-Vidyalaxmi Scheme, Bank of Baroda has several student-oriented loan schemes:

- Collateral-Free Loans Up to Rs. 7.5 Lakh: Available for all courses in India.

- Collateral-Free Loans Up to Rs. 40 Lakh: Offered for students pursuing education in 384 premier institutions across India.

- Loans Up to Rs. 50 Lakh for International Studies: Students admitted to recognized premier global institutions can avail of this facility.

Why Choose Bank of Baroda for Education Loans?

Bank of Baroda has always encouraged students in achieving their academic aspirations. With low-interest rates, nil processing charges, and a comprehensive banking network, students can trust BoB for hassle-free financial support. Additionally, the online loan processing facility means the applicant has more comfort.

Students who wish to apply for the PM-Vidyalaxmi Scheme at Bank of Baroda can log into the PM-Vidyalaxmi website and get started today.

Established in 1908 by Maharaja Sayajirao Gaekwad III, Bank of Baroda is a top finance company in India. With a 63.97% holding of the Government of India, the bank has over 165 million customers across the globe. BoB has an extensive reach of 17 countries spread across five continents, providing a hassle-free banking experience through digital channels and a strong network of branches.

By launching the PM-Vidyalaxmi Scheme, Bank of Baroda is once again confirming its commitment to financing India’s youth in pursuing education, ensuring money does not get in the way of their aspirations.